Introduction

China’s toy blind box market has evolved from niche entertainment into a flourishing industry fueled by emotional engagement, collectible appeal, and Gen Z’s appetite for novelty. By 2025, the market is expected to surpass ¥58 billion (≈$8 billion), making China the largest regional market globally. Growth has been driven by creative IP strategies, digital retail innovation, and community culture around collecting.

However, as the market matures, brands are navigating regulatory developments, product saturation, and calls for sustainability. This article explores the current landscape, emerging trends, and strategic opportunities.

Current State of China’s Toy Blind Box Market

1. Market Size & Growth

- Estimated market value in 2025: ¥58 billion

- CAGR between 7.5–10% (2020–2025)

- Traditional blind boxes dominate, though stationery and functional variants are gaining traction

- Price segmentation:

- ¥50–200 tier remains core (around 45% of sales)

- Growth in premium ranges (¥300–500) reflects brand elevation

2. Consumer Demographics & Behavior

- Women make up approximately 75% of blind box buyers

- Core segments:

- Gen Z (18–24) and young professionals (25–34)

- Motivations:

- Emotional connection, surprise mechanics, and collection bragging rights on WeChat, Xiaohongshu, and Douyin

- Emerging segments:

- 35+ nostalgic buyers

- Lower-tier cities now comprise roughly 40% of total sales, driven by e-commerce

3. Competitive Landscape

- Top 5 brands control approximately 50% of the market

- Major players:

- Pop Mart (dominant with IPs like Molly, Labubu; over 5,000 vending machines)

- Rolife (Nanci series), 52TOYS, Miniso with localized styles

- Sanrio, Bandai expanding through IP collaborations

Key Trends Shaping the Future

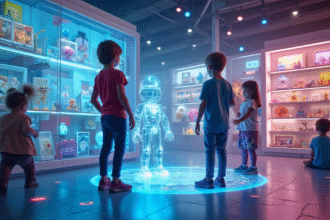

1. Digital & Hybrid Experiences

- NFT blind boxes and AR collectibles gaining traction, making up roughly 5–10% of niche segment

- Platforms like Tencent’s Magic Core support digital collectibles

- Blockchain tech improving resale market credibility

2. Regulatory & Ethical Shifts

- 2024 Chinese regulations include:

- Discouraging sales to children under 8

- Mandatory probability disclosure of rare item chances

- Encouraged spending caps, not fixed limits (¥500 is a suggested guideline)

- Brands are adopting biodegradable packaging, despite cost increases of 10–15%

3. Functional Blind Boxes & Category Expansion

- Rise of blind box+ models (stationery, cosmetics, food tie-ins)

- Popular collaborations:

- Luckin Coffee × LINE FRIENDS

- Palace Museum × Dunhuang

- Stationery blind boxes growing at approximately 20% CAGR

4. Global Expansion & Localization

- Pop Mart’s overseas revenue grew 134.9% year-on-year in 2023, reaching ¥1.066 billion

- Southeast Asia saw rapid growth

- Western markets pose challenges due to preference for known IPs (e.g., Disney) and higher supply chain costs

Strategic Recommendations for Businesses

1. Diversify IP Portfolios

- Mix original characters with licensed brands

- Leverage “Guochao” (国潮): merging modern style with traditional Chinese cultural motifs

2. Omnichannel Presence

- Live-streaming e-commerce accounts for roughly 40% of online blind box sales

- Create interactive offline experiences through pop-up shops and flagship stores

3. Innovate the Unboxing Experience

- Shift to semi-blind models, letting buyers choose themes

- Add gamified elements (AR treasure hunts, digital unlockables)

4. Prepare for Stricter Oversight

- Implement transparent probability charts

- Enhance age verification tools for online platforms

Conclusion: The Road Ahead

China’s blind box market is maturing but resilient, projected to surpass ¥85 billion by 2030. Success will depend on:

- Balancing novelty with responsibility

- Expanding into functional and digital categories

- Embracing global and local market nuances

To thrive, brands must rethink collectibility—and design experiences that engage socially, digitally, and emotionally.

References

- 2025 China Blind Box Toy Market Status Report – Jiashi Consulting

- QYResearch Industry Scan: China Stationery Blind Box Market

- China’s Blind Box Market Trends (2025–2031) – QYResearch

- Pop Mart’s Global Expansion Data – Pop Mart Financial Results (2023)

- Chinese Government Regulations on Toy Blind Boxes – Official Ministry Guidelines