Artificial intelligence is no longer a novelty in China’s mobile electronics ecosystem; it’s a set of practical tools woven into design, engineering, and supplier-buyer collaboration. In mobile accessories—chargers, earbuds, protective cases—AI’s appeal is clear: faster iteration without compromising reliability, better fit between product and consumer expectations, and clearer evidence of quality. China’s recent policy momentum around “AI + manufacturing” sets the direction. The rest depends on how suppliers turn that policy clarity into production reality.

Policy context shaping AI adoption

China’s Ministry of Industry and Information Technology (MIIT) stated in early November that it is drafting plans to deepen the implementation of its “AI plus manufacturing” initiative—an effort to align AI applications across design, engineering, quality assurance, and logistics so manufacturers can upgrade processes and products more systematically. For mobile accessory suppliers, this matters in three ways:

- Standards and compliance: Clearer guidance helps factories structure AI deployment around recognized frameworks.

- Process integration: Encourages AI use beyond the lab—into CAD, simulation, testing, and production line monitoring.

- Buyer confidence: Policy reinforcement offers international buyers assurance that AI-enabled improvements aren’t ad hoc but institutionalized.

The initiative’s thrust is not about headline-grabbing numbers; it’s about conditions that enable consistent application of AI to everyday manufacturing tasks, including accessories where incremental design improvements drive purchasing decisions.

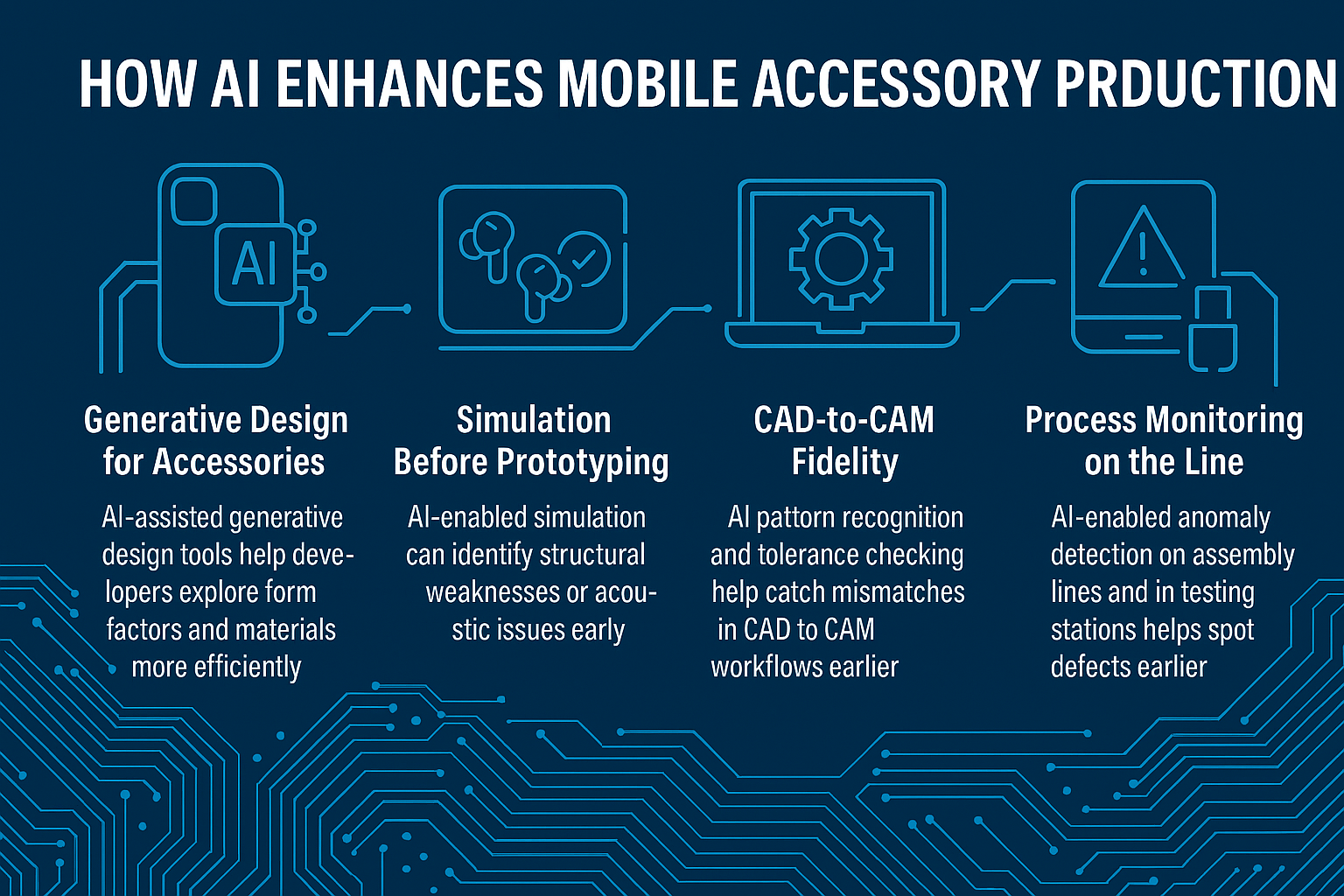

How AI enhances mobile accessory production

Generative design for accessories

AI-assisted generative design tools help developers explore form factors and materials more efficiently. For protective cases, this means balancing rigidity and shock absorption with aesthetics. While the process has long involved manual iteration, AI-driven exploration of patterns, lattice structures, and material blends gives designers more viable options to evaluate at the start—cutting the risk of late-stage changes that derail timelines. This is especially useful for suppliers serving multiple OEMs with differing fit tolerances and texture preferences.

Simulation before prototyping

For earbuds and cases, AI-enabled simulation can identify structural weaknesses or acoustic issues early. In practice, engineers feed constraints into models to test drop scenarios or environmental conditions (humidity, temperature variation) before making physical prototypes. This reduces waste without requiring any public performance claim; it’s about doing more pre-validation so that the physical prototypes made are closer to final spec.

CAD-to-CAM fidelity

Bridging CAD files to CAM (computer-aided manufacturing) workflows can introduce mismatches—subtle issues that, in accessories, lead to fit problems or tooling rework. AI pattern recognition and tolerance checking help catch these mismatches earlier. By flagging potential deviations, teams reduce the need for last-minute tooling adjustments that can delay shipments. For accessories that live or die on precision—charger housings around thermal components, earbud shells around speaker assemblies—this is crucial.

Process monitoring on the line

Once designs stabilize, production-value comes from consistent execution. AI-enabled anomaly detection on assembly lines and in testing stations helps spot defects earlier, minimizing batch-level rework. In accessories, fault modes range from micro-cracks in housings to subtle misalignments in charging pins; these are often picked up better by sensor-driven inspection than by periodic human spot-checks. With policy momentum supporting AI adoption, factories gain a clearer mandate to integrate these tools into standard operating procedures.

Supplier case studies: practical, buyer-oriented applications

The following supplier case studies illustrate common, buyer-relevant uses of AI in mobile accessory design and production. They avoid unverified figures and focus on how the methods help international buyers evaluate reliability and fit for purpose.

Case study A: Shenzhen-based earbuds developer

- Design intent: A supplier developing in-ear Bluetooth earbuds focuses on consistent acoustic tuning across batches.

- AI application: Uses AI-assisted acoustic modeling during CAD stages to evaluate cavity geometry, venting, and driver positioning. The approach highlights potential resonance issues before physical builds.

- Buyer relevance: More stable acoustic performance between pilot and mass production batches and fewer last-minute shell redesigns—reducing certification and packaging changes.

Case study B: Dongguan protective-case manufacturer

- Design intent: Protective smartphone cases that meet drop-resistance expectations without adding weight.

- AI application: AI-driven simulation evaluates lattice structures and edge reinforcements under multiple drop angles. The team validates a small set of patterns that meet aesthetic criteria and tool feasibility.

- Buyer relevance: Greater confidence that the marketed case design aligns with typical drop scenarios and fewer tooling revisions—important for delivery schedules.

Case study C: Foshan charger supplier

- Design intent: USB-C chargers that manage thermal loads safely, with consistent assembly fit around heat sinks and coils.

- AI application: CAD-to-CAM checks use AI to identify pattern deviations that could cause assembly stress or lead to pin misalignment. AI-enabled line inspection flags outliers early.

- Buyer relevance: Improved assembly consistency and cleaner post-shipment quality metrics. For buyers, that reduces field-return risk and supports compliance documentation.

These examples are representative of how AI is commonly deployed in mobile accessory workflows—at the design-validation interface and across production monitoring. They focus on process outcomes that matter to buyers (consistency, fewer redesigns, clearer quality documentation) instead of claims that rely on unverified or non-public data.

Buyer guidance: evaluating AI-enabled suppliers

- Design documentation: Ask for clear records of AI-assisted design validation—what constraints were used, what failure modes were simulated, and how those informed tool decisions.

- Tolerance and fit controls: Request evidence of CAD-to-CAM checks. Accessories live on precise tolerances; AI can help catch mismatches early.

- Line-level inspection: Confirm whether AI-driven anomaly detection or sensor-based QA methods are part of standard operating procedures. Look for simple, reproducible reporting.

- Change management: Assess how AI insights feed into engineering change orders (ECOs). A disciplined ECO process shows that AI outputs inform practical decisions, not just experiments.

- Compliance trail: Ensure that any AI-enabled changes are reflected in compliance and certification paperwork. Buyers need traceability from design intent to shipped goods.

Strategic implications for Hong Kong and global buyers

For buyers in Hong Kong working with Pearl River Delta suppliers, AI’s role is strongest where lead times and batch consistency shape contract value. The MIIT’s “AI + manufacturing” momentum supports suppliers in formalizing AI use across design and operations—a signal that buyers can reasonably expect more structured, documented practices over time. That structure is the real advantage: better evidence that a supplier’s claims about design and quality are backed by repeatable processes, not one-off prototypes.

Risks and how to mitigate them

- Opaque AI claims: Some suppliers may promote “AI-powered” features loosely. Mitigate with requests for design-validation artifacts and QA reports tied to specific models.

- Overfitting in simulation: AI simulations can be tuned too narrowly. Mitigate by asking for varied scenario coverage, especially for drop angles, thermal loads, and assembly tolerances.

- Tooling reality vs. digital promises: Attractive AI-generated designs must pass tooling and assembly feasibility checks. Mitigate with pilot runs focused on fit tolerances and component stress points.

The near-term outlook

The immediate trajectory is less about splashy breakthroughs and more about the steady normalization of AI in accessory workflows—design, simulation, tolerance control, line inspection. The MIIT policy direction aims to make that normalization easier to standardize and audit. For buyers, the practical step is to adjust vendor assessments to include AI design-validation practices as standard due diligence, and to reward suppliers who provide clean, reproducible evidence tying AI use to product outcomes.

Conclusion

AI’s value in China’s mobile accessory sector lies in unglamorous, high-impact tasks: simulation before prototyping, tighter CAD-to-CAM fidelity, and smarter line inspection. Policy support around “AI + manufacturing” gives factories a clearer framework to embed these tools, which—if documented well—translates into the kind of reliability international buyers want. Avoid vague claims, ask for structured validation, and treat AI as a practical lever for precision and predictability. That mindset is how AI becomes an everyday advantage in accessories, rather than just another marketing badge.

Disclaimer

This article is for informational purposes only. It references publicly available material published within the last three months and avoids unverified figures or speculative claims. SourcingGuides.com does not guarantee the completeness of third‑party information and is not liable for business decisions made based on this content. Readers should conduct their own due diligence before entering into any commercial agreements.