Introduction

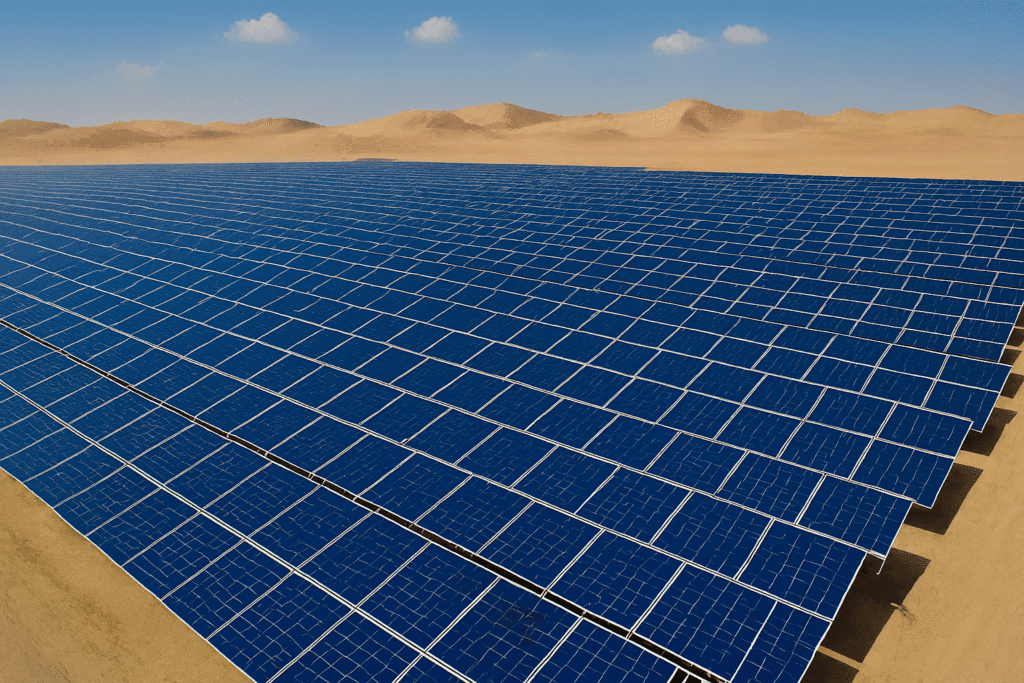

China’s solar panel sector continues to dominate the global renewable energy landscape, driven by ambitious domestic policies and unparalleled manufacturing scale. In 2025, the market has experienced a complex interplay of surging installations earlier in the year, followed by a measured slowdown amid policy reforms and supply chain adjustments. Despite challenges from overcapacity and shifting pricing mechanisms, domestic demand remains robust, absorbing a significant portion of production while exports adapt to new global realities. For B2B buyers, this environment presents compelling sourcing opportunities from reliable Chinese suppliers offering high-efficiency modules at competitive prices.

A Year of Record Installations Amid Policy Shifts

2025 has been marked by extraordinary growth in solar deployments, particularly in the first half of the year. Developers rushed to complete projects ahead of key policy changes, including the transition to market-based pricing for new renewable projects and requirements prioritizing self-consumption in distributed systems. This front-loading resulted in exceptional monthly additions, with May alone seeing a historic surge as projects qualified under previous guaranteed rates.

By November, installations reached a six-month high of 22 GW, reflecting a strong end-of-year recovery. Cumulative figures point to China approaching or exceeding previous records, with projections suggesting the nation’s solar PV capacity nearing 900 GW by year-end. This growth underscores China’s commitment to expanding non-fossil energy sources, even as policymakers address grid integration and utilization challenges.

The National Energy Administration’s data highlights how these additions have pushed wind and solar combined to surpass thermal capacity in installed terms, a milestone reflecting the rapid electrification of the power sector.

Domestic Demand Drivers and Challenges

Domestic demand in China is fueled by national goals for carbon peaking and neutrality, alongside rising electricity needs from industrialization and urbanization. Solar has played a pivotal role, with generation increases contributing significantly to meeting demand growth while displacing fossil fuels.

However, mid-year slowdowns emerged as new rules introduced uncertainty, leading to lower monthly additions in summer months compared to prior years. Analysts note that while first-half deployments were exceptionally strong, the second half has seen more moderated pace, influenced by curtailment concerns in certain provinces and a focus on project economics under competitive auctions.

Overcapacity remains a defining feature, with manufacturing capability far exceeding both domestic and global needs. This has prompted government efforts to curb inefficient production and promote consolidation, aiming for healthier industry dynamics. Despite these pressures, the sheer scale of China’s market continues to provide stability, absorbing output that supports economies of scale.

Export Trends and Global Context

While domestic installations have taken center stage, exports have shown resilience. Module shipments have diversified, with emerging markets in Asia, the Middle East, and Africa gaining prominence. Cell and wafer exports, in particular, have grown substantially, reflecting downstream assembly shifting to other countries building local capacity.

This shift highlights how Chinese suppliers are adapting upstream strengths to new trade patterns, even amid international tariffs and protectionist measures. For global buyers, this means continued access to cost-effective components, though with evolving supply chain considerations.

Sourcing Opportunities for B2B Buyers

For international businesses seeking reliable solar panel suppliers, China’s market in 2025 offers significant advantages. Leading manufacturers maintain high operating standards, advanced technologies like TOPCon and heterojunction cells, and vast production volumes that drive down costs.

B2B sourcing from China allows access to Tier-1 suppliers with proven track records in quality and delivery. Buyers can leverage this for utility-scale projects, commercial installations, or distributed systems, benefiting from modules optimized for efficiency and durability.

Key opportunities include:

- Partnering with established factories for customized specifications and long-term contracts.

- Exploring suppliers focused on sustainability certifications to align with ESG requirements.

- Capitalizing on competitive pricing amid industry consolidation, ensuring value without compromising reliability.

Platforms like SourcingGuides.com connect buyers with vetted Chinese factories, facilitating interviews, factory insights, and direct negotiations to build trust and secure advantageous terms.

Outlook and Strategic Implications

Looking ahead, China’s solar demand is poised for sustained, albeit potentially more balanced, growth. Policy emphasis on utilization, grid upgrades, and storage integration will support efficient absorption of new capacity. As the nation advances toward higher renewable shares in electricity generation, solar remains central to these efforts.

For global stakeholders, China’s advancements accelerate the worldwide energy transition, making high-quality panels more accessible. B2B players positioned to source strategically from China can gain a competitive edge in an increasingly decarbonized market.

In summary, while 2025 has brought adjustments to China’s solar sector, the underlying demand strength and manufacturing prowess position it as a cornerstone of renewable progress—with ample opportunities for informed international buyers.

References

- Bloomberg: China’s Solar Power Additions Rise to Six-Month High in November

- PVknowhow: China Solar Panel Manufacturing Report

- Ember: China solar cell exports grow 73% in 2025

- Reuters: China’s solar installations up 30% month-on-month in October

- Wood Mackenzie: Solar and storage costs are set to increase 9% in Q4 2025

- IEA: World Energy Investment 2025 – China

- Ember: China Energy Transition Review 2025

- PV Magazine: China on track to deploy 380 GW of PV in 2025

Disclaimer: The information in this article is for general informational purposes only and does not constitute financial, investment, or professional advice. Readers should conduct their own due diligence and consult qualified professionals before making any business decisions. SourcingGuides.com and the author make no representations or warranties regarding the accuracy or completeness of the data presented.