The global landscape of cross-border wealth management is undergoing a historic transformation. For decades, the flow of offshore capital was directed towards traditional European hubs, but the gravitational pull of wealth is shifting east. Driven by rapid wealth creation in Asia and increasing demand for geographic diversification, the title of the world’s largest cross-border wealth management hub is now up for grabs. This report, based on the latest industry data and analyst forecasts, analyzes the key contenders and assesses which region is most likely to claim the top spot by the end of 2025.

The Current Competitive Landscape

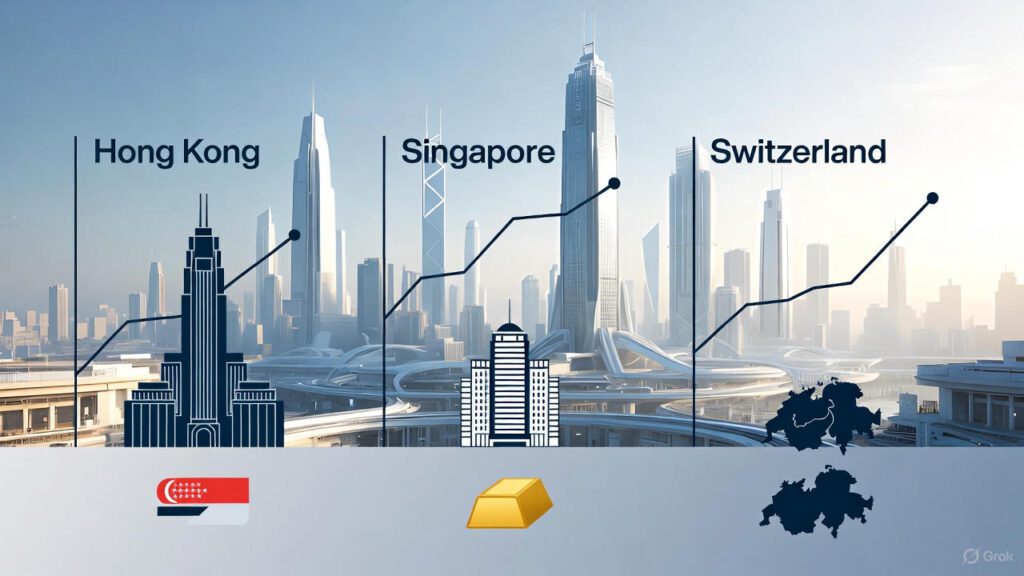

The established leader, Switzerland, remains a formidable force. In 2023, it held an estimated $2.4–2.6 trillion in cross-border assets under management (AUM), leveraging its long-standing reputation for stability and discretion, primarily serving European and Middle Eastern clients.

Challenging this dominance is Hong Kong. The city has cemented its role as the primary gateway for financial flows into and out of Mainland China. The Hong Kong Monetary Authority (HKMA) reported cross-border AUM of approximately $2.0 trillion at the end of 2023, demonstrating its massive and growing scale.

Not to be overlooked, Singapore has solidified its position as a critical neutral hub for global wealth. With about $1.5 trillion in cross-border AUM in 2023, it attracts significant capital from Southeast Asia, India, and beyond, competing aggressively through a stable political climate and proactive government policies.

The 2025 Forecast: A Projection of Change

Analyst projections point to a potential changing of the guard by 2025. The growth trajectories of the Asian hubs far outpace that of the established leader.

| Region | 2023 Cross-Border AUM (USD Trillion) | 2025 Forecast AUM (USD Trillion) | Key Growth Driver |

|---|---|---|---|

| Switzerland | 2.4 – 2.6 | 2.5 – 2.7 | Steady, mature market growth |

| Hong Kong | 2.0 | 2.8 – 2.9 | Wealth flows from Mainland China |

| Singapore | 1.5 | 1.8 – 2.0 | Inflows from Southeast Asia & India |

Sources: Boston Consulting Group (BCG) Global Wealth Report 2024, Oliver Wyman analysis (2023), HKMA, Swiss Bankers Association.

The most cited projection comes from an Oliver Wyman analysis (widely reported by Bloomberg), which forecasts that Hong Kong’s cross-border AUM could reach $2.8 – $2.9 trillion by 2025. This would position it to potentially overtake Switzerland, which is expected to see only modest growth to $2.5 – $2.7 trillion in the same period.

Key Drivers Fueling the Asian Ascendancy

Several interconnected factors are driving this seismic shift in global wealth geography:

- Unprecedented Wealth Creation in Asia: The Asia-Pacific region is the fastest-growing wealth market globally. Mainland China, in particular, is a primary engine, with its millionaire population and total household wealth expanding at a rate that generates immense demand for offshore diversification and sophisticated wealth management services.

- Strategic Policy and Infrastructure: Both Hong Kong and Singapore are engaged in a vigorous competition to attract family offices and wealth. Hong Kong has introduced tax incentives and streamlined visa schemes, with the government setting an ambitious target to host 2,700 family offices. Singapore’s Monetary Authority of Singapore (MAS) has also been highly successful, with over 1,400 single-family offices approved. This policy-driven competition is directly accelerating AUM growth.

- Geopolitical Diversification Needs: In an era of heightened global uncertainty, HNWIs are increasingly prioritizing geographic diversification. Asian hubs offer a “safe harbor” within the region’s time zone, with Hong Kong providing unique access to Chinese markets and Singapore serving as a neutral, global node for capital.

Conclusion: A New Leader with Persistent Competition

The data and growth momentum suggest a significant milestone is on the horizon: Hong Kong is projected to overtake Switzerland as the world’s largest cross-border wealth management hub by the end of 2025.

However, this forecast comes with important caveats. This shift represents a snapshot in a dynamic, ongoing competition. Singapore’s aggressive growth means the race for second place is effectively over—it is now a tight contest for first. Furthermore, this projection is sensitive to macroeconomic and geopolitical risks, including:

- The pace of economic recovery and capital flow policies in Mainland China.

- The potential for escalated U.S.-China tensions impacting financial markets.

- The ability of both Hong Kong and Singapore to continue innovating their regulatory and product environments.

While Switzerland’s era of undisputed leadership may be concluding, the new landscape will be characterized by a competitive tripartite between a declining titan and two ascending Asian powerhouses. The winner in 2025 will not just be a location, but a testament to the new centers of economic gravity in the 21st century.

This analysis is based on public reports and data from Boston Consulting Group (BCG), Oliver Wyman, the Hong Kong Monetary Authority (HKMA), the Swiss Bankers Association, and the Monetary Authority of Singapore (MAS).

Disclaimer

This article is for informational and educational purposes only and does not constitute financial, investment, or professional advice of any kind. The views expressed are analytical interpretations based on cited third-party sources and should not be considered an endorsement or recommendation. The forecasts and projections contained herein are subject to significant uncertainty and are based on assumptions that may not materialize. The global economic environment, regulatory policies, and geopolitical conditions are dynamic and can change rapidly, potentially impacting the outcomes discussed. Readers should not rely solely on this information for making any investment decisions and are strongly advised to conduct their own independent research and consult with a qualified professional before taking any action. While efforts have been made to ensure the accuracy of the information presented at the time of writing, no representation or warranty, express or implied, is made as to its completeness, accuracy, or timeliness. The author and publisher disclaim any liability for any loss or damage incurred through the use of or reliance on the content of this article.